You’ve made it through the paperwork and red tape of setting up your business—congrats! But of course, you’re probably figuring out that the paperwork and red tape never really end. Sure, the initial steps are over. But here are six steps beyond the initial incorporation paperwork that are important to take care of:

1. Annual Report and Franchise Tax

You will be required to file either an annual or biennial report for your company, depending on your state of incorporation. This includes a Franchise Tax. The purpose of the report is to update both the state and the general population on basic information about your business such as location, ownership, and number of issued stock shares, while the Franchise Tax is a fee for the ability to run a business in that state. These each may be due either on the anniversary date of your business, or a specific date set by the state (depending on what state your business is in). You can look up yours here.

2. Corporate Records

For S-Corporations and C-Corporations, it’s required that you maintain corporate records on file. The specifics can vary from state to state, but these records may include:

- Articles of Incorporation

- Bylaws

- Minutes of shareholder and director meetings

- Written communications with shareholders within the last three years

- Stock transfer ledger

- Names and addresses of current shareholders, directors and officers

- Most recent annual report

- Financial records from the last three years

For LLCs, the requirements are less stringent, but the company may still have to maintain:

- Articles of Organization

- Operating Agreement

- Minutes from various meetings

- Stock transfer ledger

- Names and addresses of all current members, managers, and officers

- Most recent annual reports and financial records.

You can find out which records you are required to keep on file in your state here.

3. Licenses

Practically every business requires some form of business license, including but not limited to:

- Accountants

- Architects

- Attorneys

- Collection agencies

- Contracting services

- Cosmetic and hair shops

- Damage appraisers

- Dealers and salespersons

- Electrical workers

- Employment agencies

- Engineers

- Manufacturing companies

- Nurseries

- Real estate brokers

- Restaurants and food vendors

- Security brokers

It’s essential to ensure that you comply with the license requirements for your business in your state. You can check that here.

4. Trademarking

Filing for a federal trademark is not required, but if you want your trademark to be recognized and protected everywhere in the country, you’ll have to file a trademark through the US Patent and Trademark Office. Some well-known examples of companies with registered trademarks include Nike and Coca-Cola, but trademarks are not limited to large national corporations. An unregistered, or common law trademark, doesn’t require additional paperwork, but is usually enforceable only within the geographic region or locale where the trademark owner is using it in business. It is incredibly important that you make sure to run a trademark search before attempting to acquire a trademark—being sued for trademark infringement is the last thing you want when you’ve just launched your business. You can learn more about trademarking here.

5. Taxes

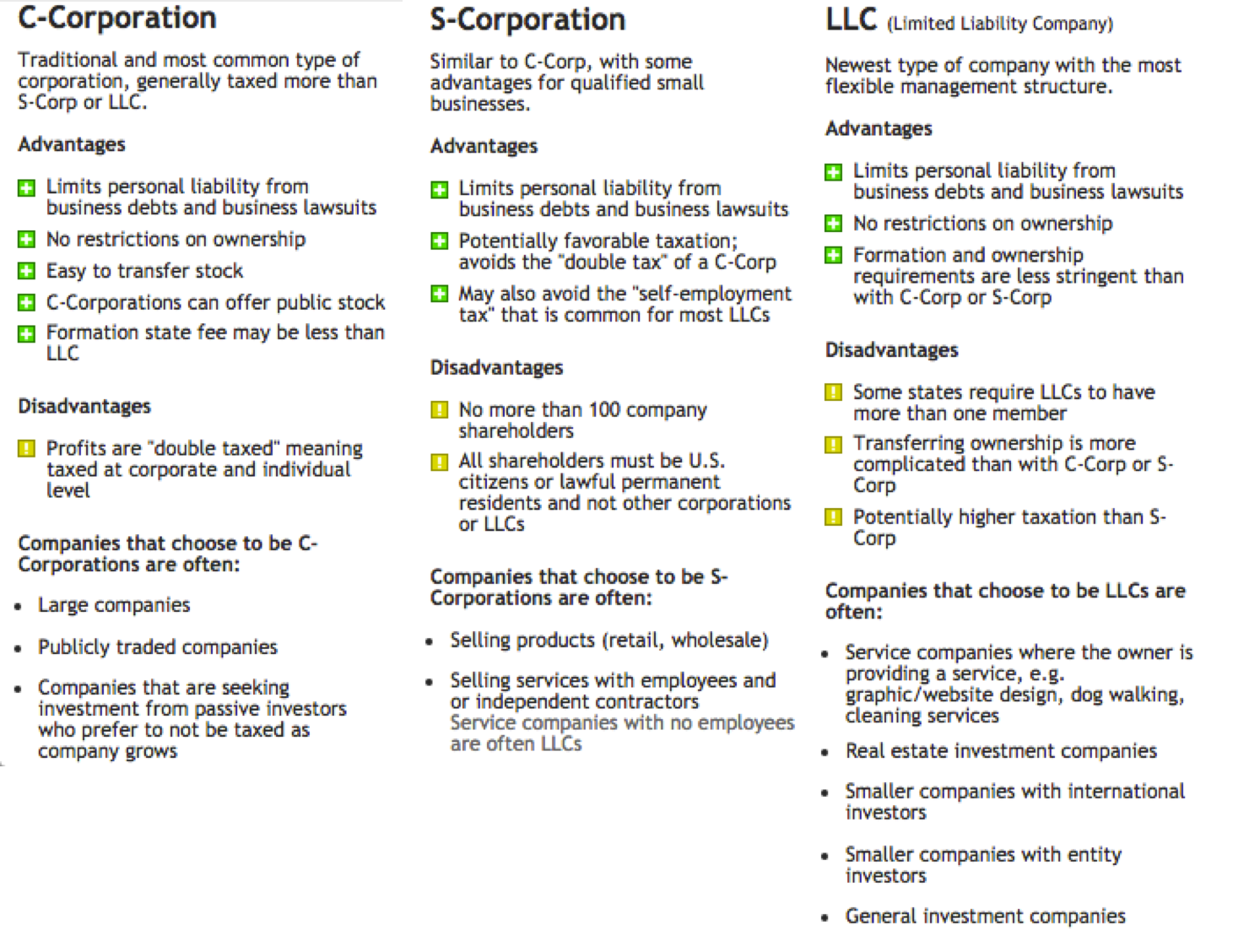

C-Corporations will have to pay both federal and state taxes at the corporate level (with the exception of Washington, South Dakota, Wyoming, Nevada and Florida).

Neither S-Corporations or LLCs are subject to taxation at the corporate level—instead, a simple attachment to the owner’s individual tax return is required. You can learn more about the tax differences between LLCs and Corporations here.

6. Publication Requirement

In some states, it is required that a new corporation or LLC files a notice of incorporation/organization in a local newspaper. The following states have such a requirement:

- Arizona (LLCs, C-Corporations, S-Corporations)

- Georgia (C-Corporations, S-Corporations)

- Nebraska (LLCs, C-Corporations, S-Corporations)

- New York (LLCs)

- Pennsylvania (C-Corporations, S-Corporations)

If you have the resources to do so, it could save a lot of stress and time to hire someone to get you through these hurdles. But just remember, you’ve gotten this far—you can do this!

Have questions about setting up your business? Please leave a comment below!

In list form:

In list form:

You don’t take yourself too seriously

You don’t take yourself too seriously

Apple

Apple