Here is everything you need to know about your business’ federal tax ID, or EIN:

What is an EIN?

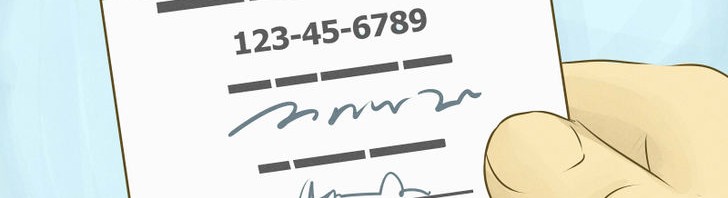

An Employer Identification Number, or more simply, a federal tax ID, is essential for starting a business. An EIN is a nine-digit number appointed to a business or organization by the IRS—kind of like a Social Security Number for your company.

The purpose of an EIN is to establish your business as a separate entity outside of yourself while filing tax returns for your business.

Why do I need an EIN?

It’s required for corporations and partnerships, businesses selling alcohol, firearms, or tobacco, for most LLCs and in some cases, sole proprietorships. In most cases it is also required for trusts, nonprofits, real estate investment entities, and cooperatives. If your business will be hiring employees—whether temporary or permanent—it is required that you obtain an EIN. However, even if it’s not required for your business, an EIN can provide specific benefits or opportunities. For example, it is a great extra step in order to protect against identity theft, and it will make opening a bank account for your business much easier.

If you’re a sole proprietor (even operating under a DBA) you are not required to obtain an EIN, and you will merely use your Social Security Number when filing taxes; however, if you would like to use an EIN, this will only help you in differentiating your business and personal finances. It should also be kept in mind that some banks require an EIN in order to open a separate business bank account.

How do I get an EIN?

Fortunately, obtaining an EIN is a short and simple process. If your business is located in the U.S., you can apply online through the IRS—but you must have a valid Taxpayer Identification Number (such as a Social Security Number or Individual Taxpayer Identification Number). If you apply online, you will be able to obtain your EIN immediately; via fax the process will take about a week, and by mail, up to four or five weeks.

When should I get a new EIN or cancel one that I have?

According to the IRS website, “Generally, businesses need a new EIN when their ownership or structure has changed.” This does not include changing the name of your business (but it does include forming subsidiary companies).

Regarding the cancellation of an EIN, there is no way to fully eliminate an EIN once it has been established. The EIN will remain the identification number for that business, regardless of whether the business ever started or if federal tax returns were filed under it; it’s never officially “destroyed” (or re-assigned, for that matter). This means that even years later, you can come back to your unstarted business and use the original EIN obtained from the IRS. However, if you decide you no longer want to use your assigned EIN number, you are able to close your business account linked to that EIN.