S-Corporation, C-Corporation, or LLC?

Rachael, Direct Incorporation Staff Member Thinking about starting your own business, but are unsure what form your business should take? Should you form an S-Corporation, C-Corporation, or LLC? While it can seem a bit confusing at first, it’s possible to figure out which type of business is best for you.

Let’s start with what they all have in common: by forming any of these types of business, you are given personal liability protection from anything related to your company. This means that your business is a separate legal entity, and any business debts or lawsuits are filed against the business and not you personally. Because it is a separate legal entity, it can be passed on to someone else like any other asset. Also, all of these forms are subject to filing annual reports and paying franchise taxes. But here’s how they differ:

Taxation

An advantage of both LLCs and S-Corporations is that instead of the company being taxed, they are taxed as an attachment to your personal tax return. C-Corporations, however, are taxed at both the corporate level and the individual level.

Ownership

In an LLC, owners are referred to as members. They are given membership Share Certificates that document what percentage of the LLC that they own. Corporations are owned by shareholders with stock certificates that show the number of shares they own out of the total number of shares. Because of the simplicity with which stock can be sold and transferred in a corporation, this can make it an appealing choice over an LLC (for which a sale of an ownership interest must be approved by other members).

While the decision-making authority of a Corporation is called the Board of Directors, for an LLC it is a Board of Managers (if there is more than one owner).

If deciding between an S-Corporation and a C-Corporation, there are two important guidelines for owners of an S-Corporation: there must be fewer than 100 shareholders, and all shareholders must be legal U.S. citizens.

Paperwork

LLCs are subject to less stringent ongoing formalities in their maintenance of corporate records, but they also tend to have higher filing fees than corporations. Also, some states require LLCs to list a dissolution date in their formation documents (whereas corporations are not required to do so).

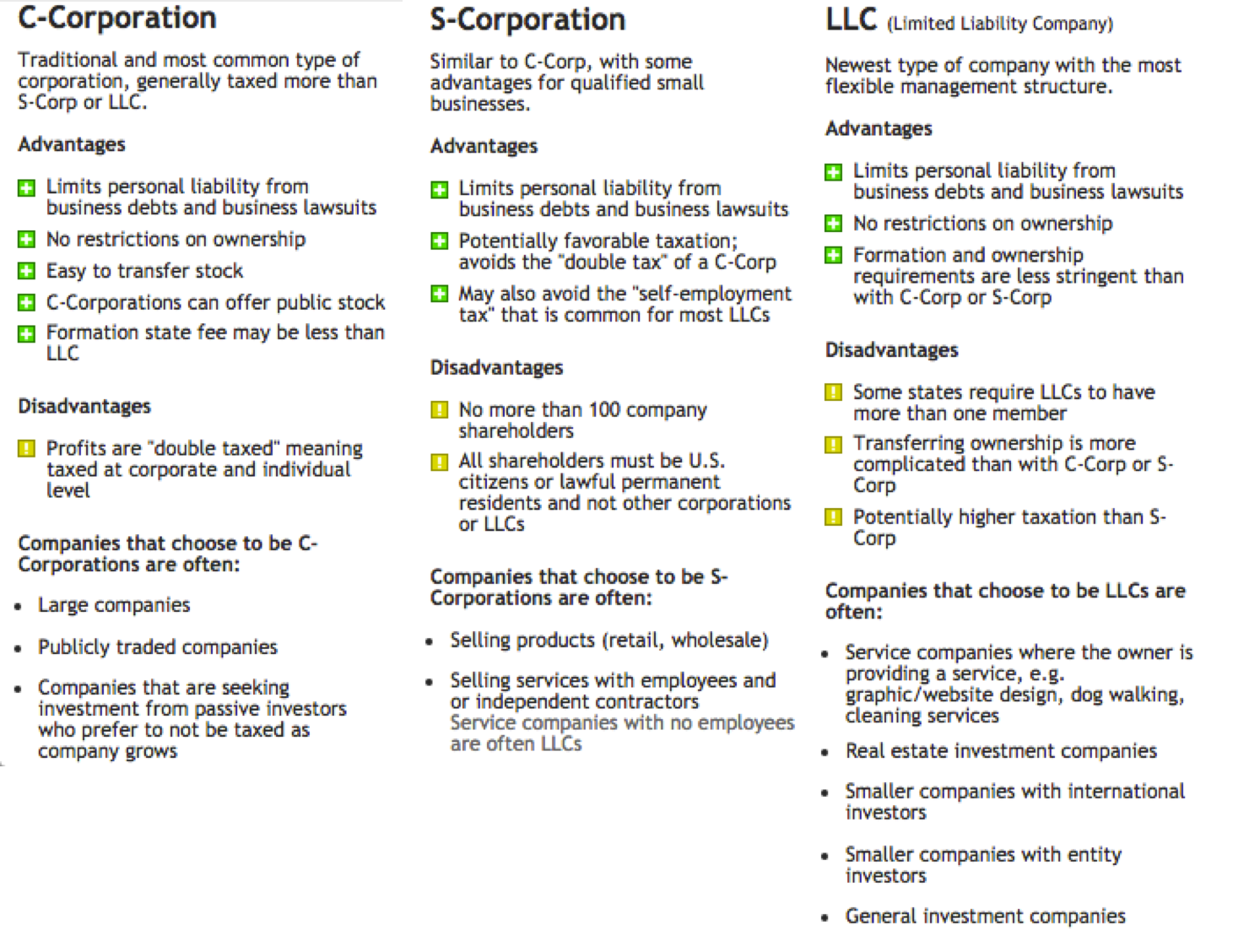

If all of this still seems a bit confusing, here is a table to parse down the key advantages and disadvantages for LLCs, C-Corporations, and S-Corporations!